What are the top priorities and challenges related to the use of cloud computing? The Flexera 2025 State of the Cloud Report draws on the insights of 759 cloud decision-makers and users globally who took part in a survey in late 2024. The results illustrate the evolution of ongoing trends in past years, while simultaneously spotlighting the emergence of new forces driving cloud usage.

Workloads move back to data centers

A noteworthy shift of applications and data back from cloud to data centers—known as repatriation—is happening. Slightly more than one-fifth (21%) of workloads and data have been repatriated. However, ongoing migration to cloud and net-new cloud workloads outstrip these cloud exits, resulting in continued cloud growth.

Analysts and experts have, for some years now, indicated that organizations are moving cloud workloads back to their own data centers, often due to the inefficiencies and expenses that result from failing to refactor applications for cloud. Although net-new cloud workloads are still increasing, the frequency of repatriation is notable.

Sustainability gains ground

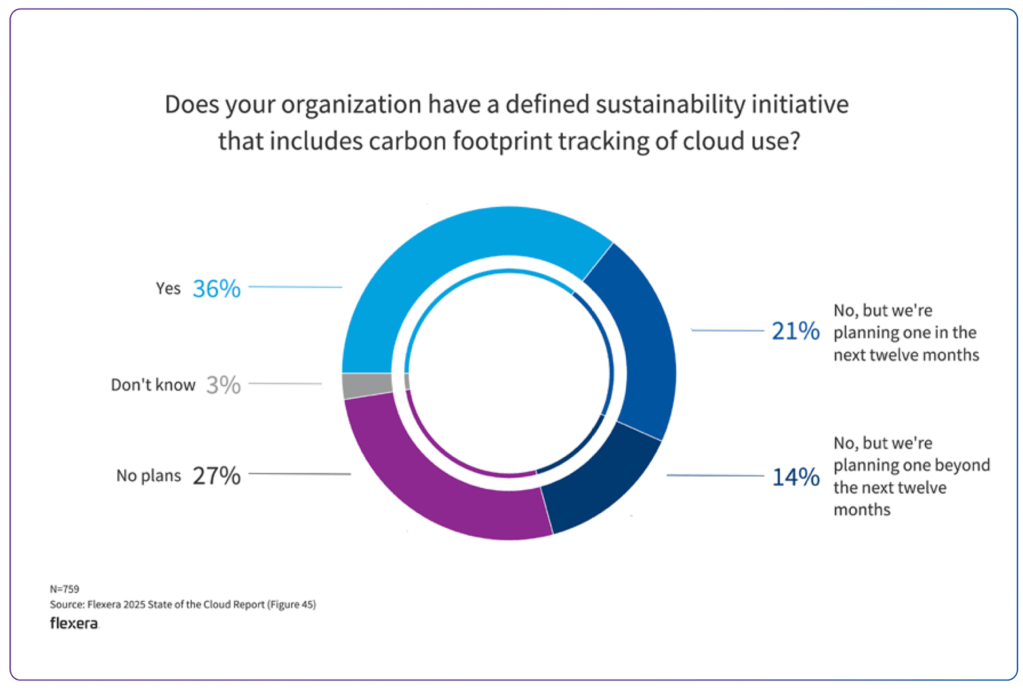

Cloud sustainability initiatives are becoming top of mind for many respondents. More than half (57%) of respondents either have or plan to have a defined sustainability initiative that includes carbon footprint tracking of cloud use within the next 12 months. With more than a third (36%) of all respondents already tracking their cloud carbon footprint, the need to do so has clearly been gaining traction.

Among European respondents, the number tracking their cloud carbon footprint rises to 43%. The gap between European respondents and respondents overall is closing; as an increasing number of global organizations adopt and adhere to important sustainability standards, this gap is expected to shrink even further.

Flexera

Generative AI is becoming mainstream

Not a surprise: Adoption of AI-related public cloud services is exploding. Almost half of respondents indicate that their organizations already use artificial intelligence/machine learning (AI/ML) platform-as-a-service (PaaS) services. This year’s survey also shows a surge in the use of data warehouse services, which are often used to feed AI models.

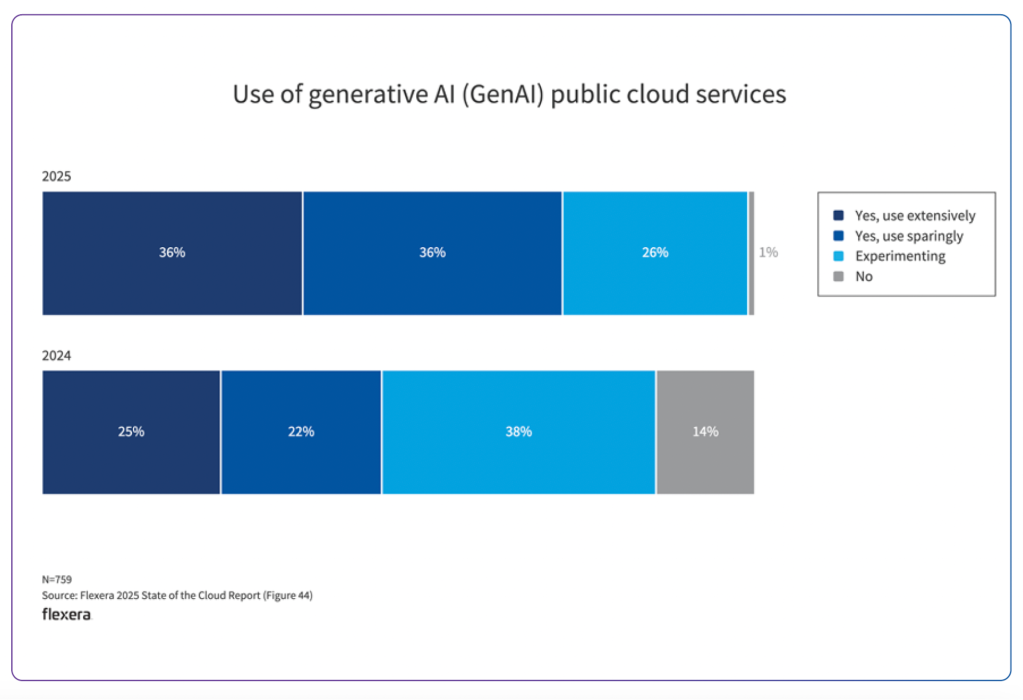

Generative AI use is also booming. Nearly three-quarters (72%) of organizations already use genAI either sparingly or extensively; another 26% are currently experimenting with genAI. Not only is genAI here to stay, but it’s becoming mainstream.

Flexera

Cloud spend and security are the top challenges

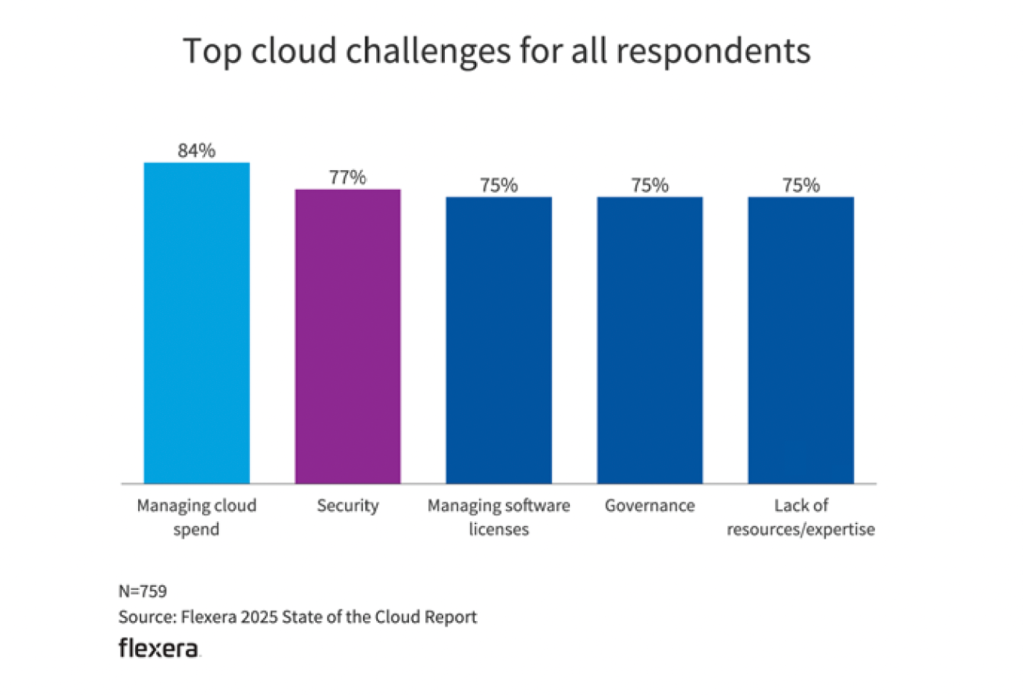

Managing cloud spend is the top cloud challenge for organizations of all sizes, reported by 84% of respondents. As additional workloads find their way into the cloud, the need to manage and optimize the associated spend becomes paramount. Nearly nine out of 10 (87%) identify “cost efficiency/savings” as their top metric for assessing progress against cloud costs, making it the leading metric in this category, jumping from 65% a year ago. Similarly, “cost avoidance,” which can be achieved with proper license management, rose from 28% to 64% during the same period. As software-as-a-service (SaaS) usage increases, the focus on SaaS licensing is gaining increased attention, given the significant impact that SaaS expenses have on driving up cloud bills.

Following cloud spend as the top cloud challenge is security. Reported by 77%, security—always a top concern in the digital age—is the second-largest challenge for cloud initiatives. Among the tools used for managing multi-cloud initiatives, security tools take the number-one spot, with 55% of all respondents using them.

Public cloud adoption continues to accelerate

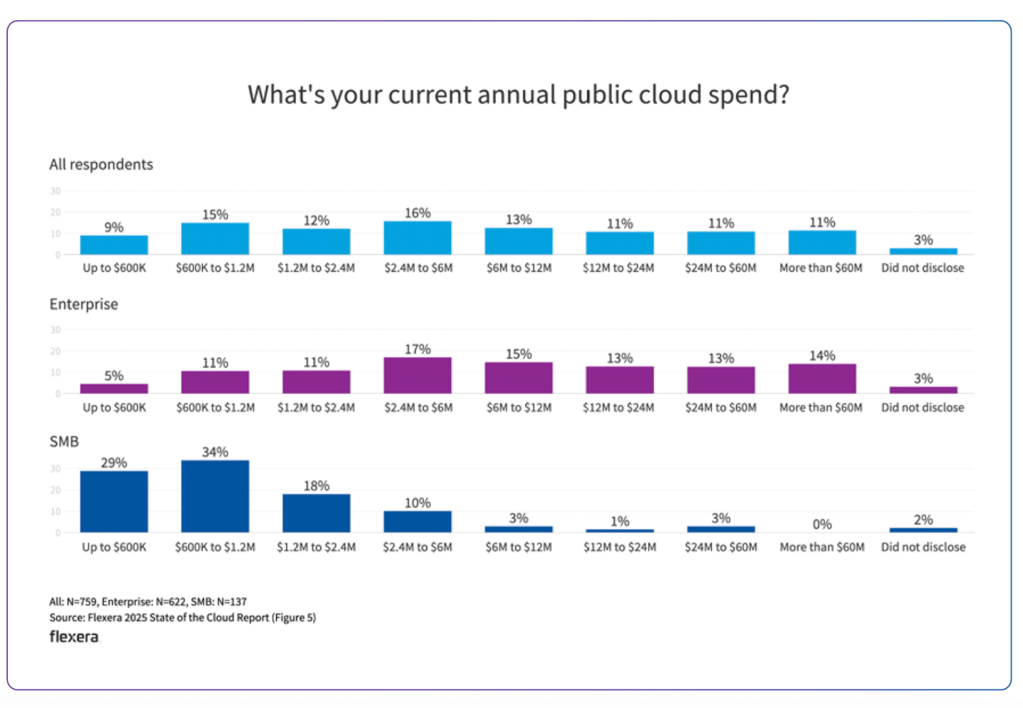

Public cloud spend continues to increase, with a third (33%) spending more than $12 million a year, up from 29% of respondents last year. Among enterprises (with more than 1,000 employees), the number spending this amount goes up to 40%. Even as cloud costs rise, more workloads are finding a home in the cloud. SaaS expenses remained fairly consistent year over year.

An area of hesitance is around sensitive data. Organizations remain cautious about moving sensitive data to the cloud, although more than a third indicate that all non-sensitive data will move to the cloud.

Flexera

Centralized initiatives grow

The approach to governing and optimizing cloud and SaaS costs is shifting from vendor management teams towards cloud centers of excellence (CCOEs) and FinOps teams, representing a centralized approach to cloud. Today 69% of respondents have a CCOE or central cloud team.

Additionally, cloud cost optimization strategies are increasingly being handled by FinOps teams. Nearly three-fifths (59%) of respondents now indicate that they have a FinOps team for some or all of their cloud cost optimization strategies, up from 51% a year ago. As FinOps gains additional traction within the cloud community, particularly with SaaS and data centers now part of the FinOps scopes, reliance on FinOps teams across organizations is anticipated to rise.

Flexera

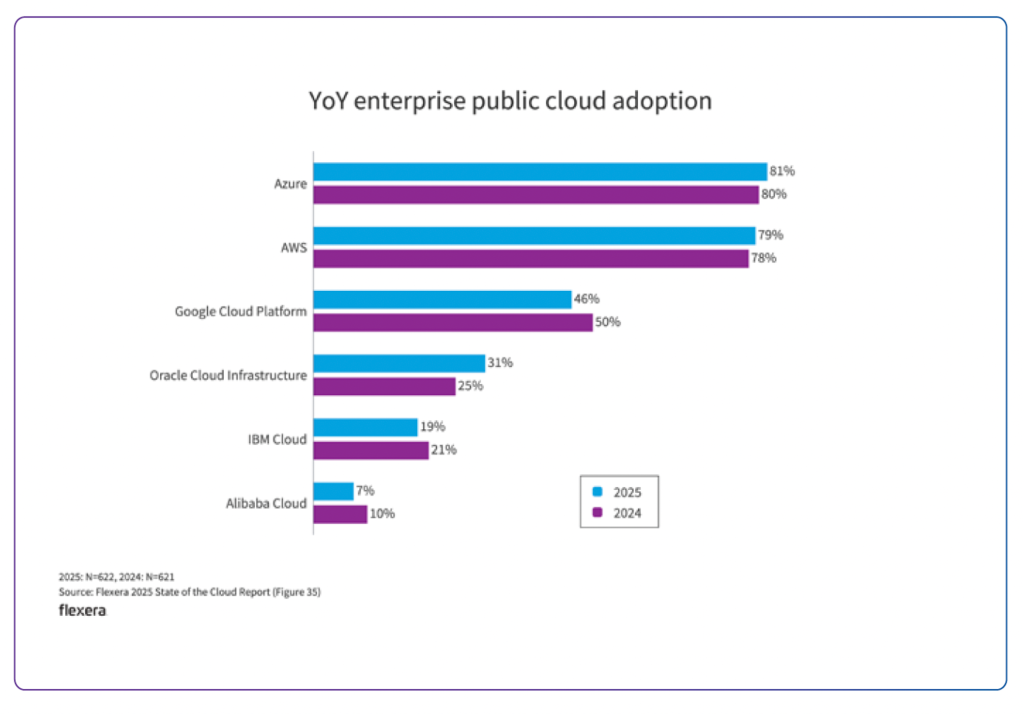

AWS and Azure compete for dominance

Year over year, this ongoing research shows that there has been little change among the leaders, with many organizations seemingly having found their steady state regarding the cloud—or mix of clouds—they’re using. Among all respondents, it boils down to a race that continues between Amazon Web Services (AWS) and Microsoft Azure as leading public cloud providers. A close contest in recent years, the two providers trade leads, based on the number of workloads running.

Flexera

Historically, enterprises are more likely to utilize Azure than are small- to medium-sized businesses (SMBs, with fewer than 1,000 employees). Today, among enterprises, AWS holds a slight lead (53%) over Azure (50%) among organizations that run “significant workloads,” while Azure (81%) has the lead over AWS (79%) when also including “some workloads.”

As part of cloud strategy, organizations continue to embrace multi-cloud: 70% of respondents embrace hybrid cloud strategies, using at least one public and one private cloud, while the remaining 30% use only public clouds or private clouds. Large enterprises (with more than 10,000 employees) make use of multi-cloud tools more than smaller organizations, regardless of the tool type.

Looking ahead

Growing cloud usage, initiatives to optimize costs, competition between the top cloud providers, and the ongoing use of AI all promise to be hallmarks of cloud programs in 2025. The new emphases on repatriation and sustainability will modulate how cloud initiatives are managed.

Brian Adler is senior director of cloud market strategy at Flexera. He was previously a senior director analyst at Gartner and a member of the FinOps Foundation governing board.

—

New Tech Forum provides a venue for technology leaders—including vendors and other outside contributors—to explore and discuss emerging enterprise technology in unprecedented depth and breadth. The selection is subjective, based on our pick of the technologies we believe to be important and of greatest interest to InfoWorld readers. InfoWorld does not accept marketing collateral for publication and reserves the right to edit all contributed content. Send all inquiries to doug_dineley@foundryco.com.

What are the top priorities and challenges related to the

use of cloud computing? The Flexera 2025

State of the Cloud Report draws on the insights of 759 cloud

decision-makers and users globally who took part in a survey in late 2024. The

results illustrate the evolution of ongoing trends in past years, while

simultaneously spotlighting the emergence of new forces driving cloud usage. Repatriation highlights the move back to data centersA noteworthy shift of applications and data back from

cloud to data centers— known as repatriation—is happening. Slightly more than

one-fifth (21%) of workloads and data have been repatriated. However, ongoing migration to cloud and net-new cloud workloads

outstrip these cloud exits, resulting in continued cloud growth. Analysts and experts have, for some years now, indicated

that organizations are moving cloud workloads back to their own data centers,

often due to the inefficiencies and expenses that result from failing to

refactor applications for cloud. Although net-new cloud workloads are still

increasing, the frequency of repatriation is notable. Sustainability

gains groundCloud sustainability

initiatives are becoming top of mind for many respondents. More than

half (57%) of respondents either have or plan to have a defined sustainability initiative

that includes carbon footprint tracking of cloud use within the next 12 months.

With more than a third (36%) of all respondents already tracking their cloud

carbon footprint, the need to do so has clearly been gaining traction. Among European

respondents, the number tracking their cloud carbon footprint rises to 43%. The

gap between European respondents and respondents overall is closing; as an

increasing number of global organizations adopt and adhere to important sustainability

standards, this gap is expected to shrink even further.

Ongoing trends continueIn

addition to the above standouts revealed in this year’s research, ongoing

trends continue to evolve in ways that impact day-to-day business management

for the organizations using cloud. Generative AI

is becoming mainstream:Not a surprise: adoption of AI-related public cloud services is

exploding. Almost half of respondents indicate that their organizations already

use artificial intelligence/machine learning (AI/ML) platform-as-a-service (PaaS)

services. This year’s survey also shows a surge in the use of data warehouse

services, which are often used to feed AI models. Generative AI (Gen AI) use is also booming. Nearly three-quarters (72%)

of organizations already use GenAI either sparingly or extensively; another 26%

are currently experiment with GenAI. Not only is GenAI here to stay, but it’s

becoming mainstream, at least in some capacities.

Cloud spend & security are the top challenges:Managing

cloud spend is the top cloud challenge for organizations of all sizes, reported

by 84% of respondents. As additional workloads find their way into the cloud,

the need to manage and optimize the associated spend becomes paramount. Nearly

9/10 (87%) identify “cost efficiency/savings” as their top metric for assessing

progress against cloud costs, making it the leading metric in this category,

jumping from 65% a year ago. Similarly, “cost avoidance,” which can be achieved

with proper license management, rose from 28% to 64% during the same period. As

software-as-a-service (SaaS) usage increases, the focus on SaaS licensing is

gaining increased attention, given the significant impact that SaaS expenses

have on driving up cloud bills. Following cloud spend as

the top cloud challenge is security. Reported by 77%, security—always a top

concern in the digital age—is the second-largest challenge for cloud initiatives.

Among the tools used for managing multi-cloud initiatives, security tools take

the #1 spot, with 55% of all respondents using them. Public cloud

adoption continues to accelerate: Public cloud spend is increasing, with a third (33%) spending more than

$12 million a year, up from 29% of respondents last year. Among enterprises (with

more than 1,000 employees), the number spending this amount goes up to 40%. As

cloud costs rise, more workloads are moving to or born in the cloud. SaaS

expenses remained fairly consistent year over year. An

area of reticence is around sensitive data. Organizations remain cautious about

moving sensitive data to the cloud, although more than a third indicate that

all non-sensitive data will move to the cloud.

Centralized

initiatives grow:The approach to governing and optimizing cloud and SaaS costs is

shifting from vendor management

teams towards cloud centers of excellence (CCOEs) and FinOps teams,

representing a centralized approach to cloud. Today 69% of respondents have a

CCOE or central cloud team. Additionally, cloud cost

optimization strategies, in particular, are increasingly being handled by

FinOps teams. Nearly three-fifths (59%) of respondents now indicate that they

have a FinOps team for some or all of their cloud cost optimization strategies,

up from 51% a year ago. As FinOps gains additional traction within the cloud

community, particularly with public cloud and SaaS now part of the

FinOps Scopes, reliance on FinOps teams across organizations is

also anticipated to rise.

Top vendors compete for dominance: Year over year, this ongoing research shows that

there has been little change among the leaders, with many organizations

seemingly having found their steady state regarding the cloud—or mix of clouds—they’re

using. Among all respondents, it boils down to a race that continues between Amazon Web Services (AWS) and Microsoft Azure

as leading public cloud providers. A close contest in recent years, the two

providers trade leads, based on the number of workloads running.

Historically,

enterprises are more likely to utilize Azure than are small- to medium-sized

businesses (SMBs, with fewer than 1,000 employees). Today, among enterprises, AWS

holds a slight lead (53%) over Azure (50%) among organizations that run

“significant workloads,” while Azure (81%) has the lead over AWS (79%) when

also including “some workloads.” As part of cloud strategy,

organizations continue to embrace multi-cloud: 70% of respondents embrace

hybrid cloud strategies, using at least one public and one private cloud, while

the remaining 30% use only public cloud(s) or private cloud(s). Large

enterprises (with more than 10,000 employees) make use of multi-cloud tools

more than smaller organizations, regardless of the tool type. Looking aheadGrowing cloud usage, initiatives to optimize costs, competition between

the top cloud providers, and the ongoing use of AI all promise to be hallmarks

of cloud programs in 2025. The new emphases on repatriation and sustainability

will modulate how cloud initiatives are managed.

Brian Adler is senior director of cloud market strategy at Flexera

and was previously a senior director analyst at Gartner and a former member of

the FinOps Foundation governing board.